The financial industry is changing—and so is the marketplace. Combined, these trends have created a “perfect storm” of opportunities and challenges, which many companies are not prepared to weather. Those that can navigate these new waters by tailoring their business tactics, products and services are destined to reap the rewards.

An industry in flux

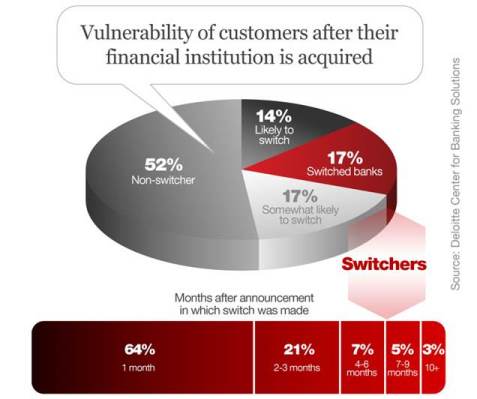

Over the last five years, we’ve seen a large number of mergers and acquisitions within the financial services industry at every level. In fact, the total number of offices managed by FDIC-insured institutions peaked in 2009, and has shrunk by nearly 5 percent since. Analysts and industry leaders further predict that consolidation will continue at a faster pace in 2015. As the accompanying graphics show, this will make many institutions vulnerable to churn.

Finally, the financial industry will also have to adjust to the fact that customer profiles have changed significantly.

Here come the Millennials

Audience demographics have indeed shifted, and not just for the financial sector. Most notably, Millennials (those born between 1982 and 2004) have officially replaced Baby Boomers as the largest group of consumers, now comprising upwards of 40 percent.

A good portion of them are just starting out in life, hence busily shopping for new banking products, primarily checking accounts.

Growing by acquisition. Winning by a tactical shift

While keeping their finger on the industry’s pulse, smaller banks and credit unions must start catering to this new audience immediately to keep from being trounced by their larger counterparts.

Community banks will likely find it desirable (or a necessity) to sell or acquire other entities to get the capital, resources and expertise needed to develop enhanced strategies and offerings. Here are some tactics they would do well to try:

• Sharper, more differentiated marketing

Studies show that Millennials do not have a seasoned loyalty toward their financial institution. While this is bad news for the incumbent, challengers with superior creative, strategies and offers have a decent chance of wooing new customers.

• Convenient branch locations

Interestingly, Millennials tend to gravitate toward larger national banks. Moreover, according to The Financial Brand, roughly 70 percent prefer to open an account at a branch—a slightly higher rate than that of Boomers. More brick-and-mortar locations will surely spread brand awareness and consideration amongst this audience.

• Expanded mobile banking

• Expanded mobile banking

Millennials grew up in the digital age, and the majority prefer mobile banking for day-to-day transactions once their account has been opened at a branch. A recent survey posted on FindABetterBank.com found that over 70 percent of Millennials considered mobile banking a “nice-to-have” or “must-have.” This compared to just over 50 percent of shoppers age 30-plus.

• Low fees

Millennials are often in the midst in significant life changes that impact their financial freedom: facing student loan debts after graduating from college; looking for a new or better job; preparing to get married or buy a home. Plus, like the rest of us, they’re price shoppers, and so are apt to choose a bank that can offer them accounts with low fees.

Financial institutions should also strongly consider offering more products that don’t require high balances to avoid discouraging this new audience.

To compete effectively against larger entities in acquiring and retaining Millennials, small and mid-sized banks should give serious consideration to these business tactics. Millennials are young, smart and savvy—keen enough to notice when a seemingly better deal comes along.