At 75 million strong, Millennials have officially surpassed Baby Boomers as the nation’s largest consumer group. But this younger generation faces many financial challenges which at the same age their elders did not, notably an uncertain world economy, comparatively large student debt, reduced upward mobility, plus a big erosion in middle-class spending power.

So, it comes as no surprise to learn that 41% of Millennials—AKA Generation Y—are chronically stressed about their finances (1), or that half don’t believe they will receive Social Security when they retire (2).

An erosion of trust

Millennials were also hit hard by the Great Recession of 2008, which was spawned in part by the often sketchy investment practices of many seemingly solid financial institutions. Like many people, they began losing trust in banks as secure, lucrative places to put their money and from which to get support at crucial life stages—pursuing higher education, finding a new job, and planning a vacation.

Instead, Millennials tend to rely on family and friends, search engines, plus social networks for insights and advice.

Bring on the “un-banks”

Amid this malaise, many non-bank players have stepped in to save the day, serving as disruptive but largely positive change agents. Leveraging digital technology to offer things traditional banks either could not or would not, these so called “fintech” companies have begun providing:

- Payment services (digital wallets and peer-to-peer payments, e.g., Venmo)

- Investments (through crowdfunding and peer-to-peer lending)

- Financing and insurance

Given their tenuous relationship with traditional banks, and their love of all things digital, it is not surprising that Millennials have turned to fintech companies for help and financing at their various life stages.

What traditional banks can do to curry favor with Millennials

Given a ready audience among Millennials, it’s safe to assume that fintech firms will continue gobbling up market share. If traditional banks want to stem their losses, they will need to adopt new strategies to stay competitive.

These banks have an opportunity to leverage the vast amounts of data available to connect and build relationships with Millennials—relationships founded on:

- Personalized service

- Accurate and prompt problem-solving

- Engaging, relevant content

- Trustworthy advice

- Convenience

Yes, content still reigns supreme

Millennials are the experiential generation, and have very high expectations when it comes to brand communications. Traditional banks should take heed: interactions should be personal, have a human touch, and avoid sounding like corporate speak.

Millennials are also hungry for knowledge, ready to learn online, and appreciate easy-to-digest content to make better decisions. Contextual engagement that is both smart and timely is key to capturing their attention.

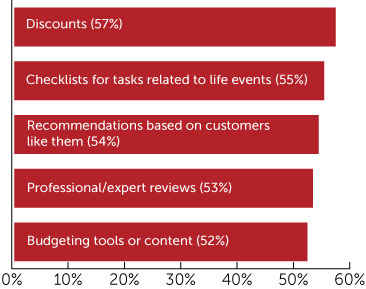

According to the Oracle study (3), Gen Y’ers would be most receptive to the following types of content:

Better make it mobile

Of course, mobile devices are fast becoming ubiquitous across all demographics, but none more so than Millennials. 75% of them polled indicated that they were somewhat reliant on mobile banking, 25% completely reliant (4).

Again, due to the high expectations of this group, mobile sites erected by traditional banks can’t just be dumbed down versions of Internet banking. They must provide an easy, effective and engaging user experience.

Fintechs:

If you can’t beat ‘em, buy ‘em

Corporate culture and executive mentalities are often deeply entrenched and hard to change. Therefore, instead of trying to transform themselves cataclysmically, traditional banks might consider partnering with fintech companies to continue currying the interest of Millennials.

In fact, many financial giants like JPMorgan Chase, HSBC, Goldman Sachs and Citigroup have already either aligned themselves with these start-ups, or acquired them outright.

Change buys a lot

As it does with any generational flux, the rise of Millennials is causing a seismic shift across many industry segments, financial in particular. Add strong external economic drivers and you have a veritable earthquake that traditional banks will have to ride out and, to some extent, rebuild from.

Deep thinking, keen data analysis, smart marketing, good strategic decisions and a big dose of empathy will help make them successful.

Tune in next week as we talk more about Millennials and financial services marketing! In the meantime, we've another financial services blog post you may fancy, found here.

Sources:

1 Bank of America/USA Today Better Money Habits 2015 Report

2 Financial Brand Forum 2016 Session

3 Oracle: http://oracledigitalbank.com/

4 The Financial Brand: http://thefinancialbrand.com/58878/millennial-digital-banking-research/