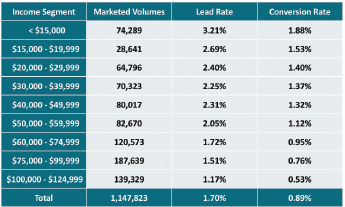

Dig deep and you’ll find something very interesting about your Medicare segments (perplexing may be a better word). Through our 25 years of Medicare marketing experience, we have uncovered an interesting trend when determining which prospects merit allocating the most marketing budget to acquire.

More is less and less is more—what?

Amazing but true: lower income audience segments respond and convert better, but are more likely to defect year over year, while top income folks respond and convert at a lower rate, but tend to stay longer. Hmm.

Anderson has tested and proven the pattern time and again.

Solution: Follow the money

This paradox can seriously body-slam your budget if you’re not careful. Here’s why:

The money you spend luring the lowest-income prospects may pay off right away, yet not deliver the best ROI in the long run. On the other hand, you’ll spend comparatively more to win fewer high-income converts, but they’re likely to have a higher lifetime value, or LTV, and be profitable to you.

So is it worth targeting the extreme ends of your prospect universe? Where’s the breaking point in

terms of ROI? Too hard to calculate?

Heed your marketing Yoda: model, you must

The best way to solve this challenge and, more importantly, optimize your spending, is to track lifetime value for all your segments—from the lowest to the very highest income, then model them using LTV.

Only then can you tie a specific monetary ROI to a specific segment, or decile, and decide how much you’re willing to spend to acquire them. Sound complicated? It is. But capitalizing on insights like these can help improve your Medicare marketing ROI significantly.

Check this out to see some of our Medicare case studies where this kind of Medicare-focused insight paid off.

You may also be interested in some of our other reads: